TA in the Community

TA has a longstanding commitment to maintaining the highest standard of ethics while building lasting value through our investments. Our approach is rooted in a deep responsibility to be good stewards of capital for our limited partners, portfolio companies and our broader communities. Closely aligned with this mission is supporting a healthy environment, advancing social equality and dignity, and promoting good governance principles.

Outside our firm, we are dedicated to supporting the communities in which we live, work and invest. We invite employees to participate in various events and charity work throughout the year and encourage our people to champion personal causes. Past non-profit partners include Cradles to Crayons (Boston), the Boys & Girls Club (Menlo Park), Second Harvest of Silicon Valley (Menlo Park), FareShare (London), Food Angel (Hong Kong) and Nanhi Kali (Mumbai).

In 2021, we were particularly proud to continue our long-standing partnerships with the Pan-Mass Challenge, in support of the Dana-Farber Cancer Institute, and the Greater Boston Food Bank.

Learn more about our commitment to responsibility here.

About TA

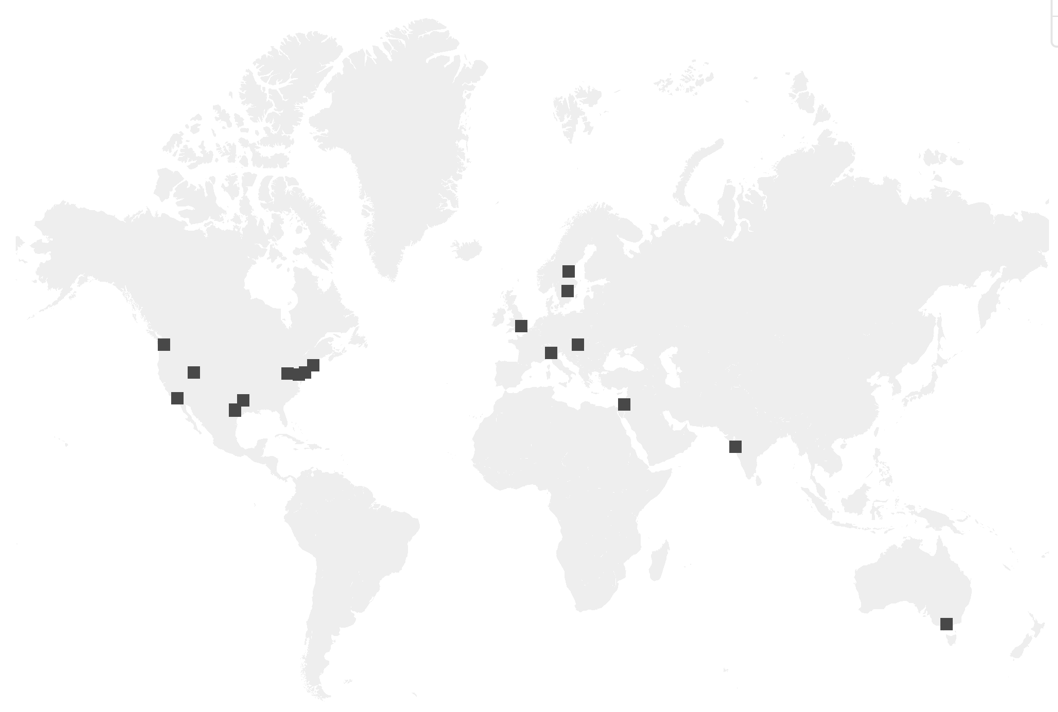

For more than 50 years, TA, a leading global growth private equity firm, has partnered with hundreds of profitable, growing companies worldwide in our five target industries to help them reach their full potential. Investing as either a minority or a majority investor, our industry specialists work with owners and management to accelerate growth and create lasting shareholder value. Learn more about TA at www.ta.com.

Logo.png)

.png)

.jpg)